The History of Foreign Exchange Market (Forex) Trading

The modern foreign exchange market is a technological marvel, a decentralized global network where over $7.5 trillion changes hands every single day. But this high-speed, digital world has roots that stretch back thousands of years, long before computers or even paper money existed.

Understanding the history of forex trading reveals a fascinating journey from simple barter systems in ancient civilizations to the sophisticated, algorithm-driven market we know today. This evolution was driven by trade, innovation, and major global events that shaped the very nature of money and international finance.

Ancient Origins: From Barter Systems to Standardized Coins

The earliest form of foreign exchange wasn’t about currency at all—it was about goods. In ancient times, beginning around 6000 BCE in Mesopotamia, commerce was conducted through barter, the direct exchange of goods and services.

As trade routes expanded, this system became inefficient. To solve this, societies began using precious metals like gold and silver as a common medium of exchange. This was a crucial first step, but it was the introduction of standardized currency that truly revolutionized trade.

The First Coins and Early Exchange Brokers

The Lydians, in the 7th century BCE, are credited with creating the first stamped gold and silver coins. This innovation provided a reliable, standardized measure of value, making cross-cultural trade far more efficient. With different empires minting their own coins, a new profession emerged: the money changer.

These early exchange brokers, known as argentarii in the Roman Empire, would set up stalls in marketplaces to assess the value of various coins and facilitate exchanges for traveling merchants. This practice of determining the relative value of different currencies forms the foundational concept of forex trading and is an early example of people tracking historical exchange rates to conduct business.

Medieval and Renaissance Innovations

During the Middle Ages, international trade flourished, particularly in European commerce centers like Florence and Venice. This period saw the rise of powerful banking families, most notably the Medici family of Florence in the 15th century.

The Medici and other banking houses created financial instruments that were precursors to modern forex practices. They developed the nostro account, a method of bookkeeping that recorded debits and credits in both local and foreign currencies, allowing them to manage international transactions without physically moving large amounts of gold.

The Era of Fixed Exchange Rates

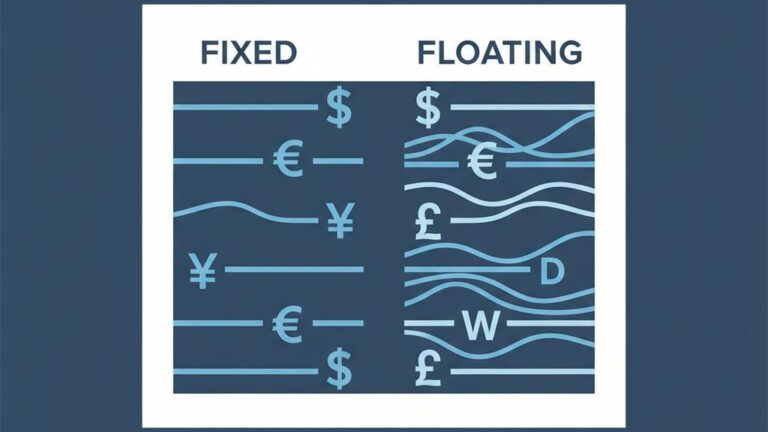

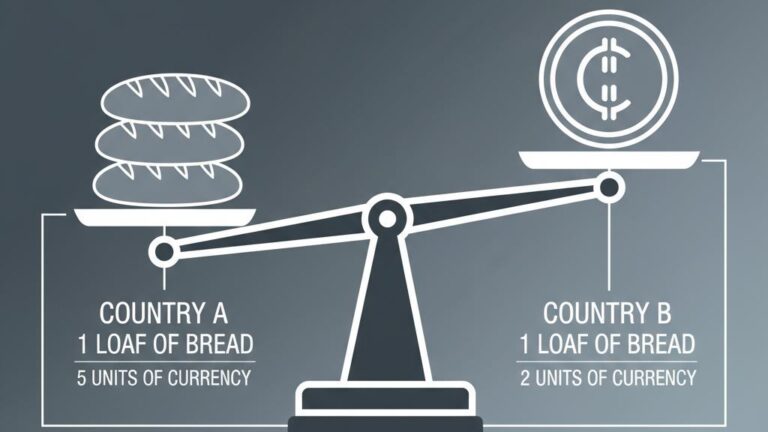

As global trade became more institutionalized in the 19th century, nations sought a way to create stability and predictability in currency values. This led to the widespread adoption of fixed exchange rate systems, where a currency’s value is pegged to another asset.

The Gold Standard

First adopted by Britain in 1821 and the United States in 1834, the Gold Standard became the cornerstone of international finance for nearly a century. Under this system, a country’s currency was directly linked to a specific amount of gold, creating fixed exchange rates between participating nations.

This system provided immense price stability and facilitated a boom in world trade. However, the economic pressures of World War I forced many countries to abandon it to finance their war efforts. The difference between this system and what came next is a core part of understanding the history of fixed vs. floating exchange rates.

The Bretton Woods Agreement

Following the devastation of World War II, allied leaders met in Bretton Woods, New Hampshire, in 1944 to design a new global economic order. The resulting Bretton Woods Agreement established the International Monetary Fund (IMF) and the World Bank.

The system pegged the U.S. dollar to gold at a rate of $35 per ounce, and all other currencies were then pegged to the U.S. dollar. This created a “fixed-but-adjustable” rate system that governed international finance until the early 1970s. For an in-depth look at this pivotal moment, the Federal Reserve History project provides extensive documentation.

The Modern Forex Market Origins

The Bretton Woods system came under increasing strain as the U.S. economy faced growing deficits and pressure on its gold reserves. In 1971, President Richard Nixon officially suspended the dollar’s direct convertibility to gold, effectively ending the Bretton Woods system.

This event, often called the “Nixon Shock,” ushered in the era of floating exchange rates, where currency values are determined by supply and demand in the open market. The lifting of capital controls and this transition to a floating system are the true modern forex market origins. Initially dominated by large banks and corporations, the market’s structure was forever changed by the rapid pace of globalization and technology that followed.

The Technological Impact on Forex Trading

Technology has been the single most powerful force in shaping the forex market over the last 50 years. From paper-based ledgers to artificial intelligence, innovation has continually increased the speed, accessibility, and volume of trading.

From Telephones to Computers

In the 1970s and 1980s, trading floors moved from paper and telex machines to telephone dealing and early computerized systems. This allowed for faster execution and connected global financial centers like London, New York, and Tokyo more effectively than ever before.

The Internet and Retail Trading

The 1990s brought the most significant change: the internet. The launch of digital trading platforms democratized the market. In 1996, some of the first online retail forex platforms were introduced, allowing individuals, not just institutions, to access the market directly from their computers.

High-Frequency and Algorithmic Trading

The 21st century saw the rise of high-frequency trading (HFT), algorithmic strategies, and artificial intelligence (AI). These technologies use complex algorithms to execute millions of orders in fractions of a second, now accounting for a massive portion of the market’s daily volume.

FX Market History Timeline: Key Milestones

The journey of forex from barter to bots can be summarized by several key moments:

- 6000–3000 BCE: The barter system is used in Mesopotamia and other ancient civilizations.

- ~7th century BCE: The Lydians introduce the first stamped gold and silver coins, standardizing currency.

- 15th Century: The Medici family in Florence pioneers international banking with tools like the nostro account.

- 1821–1834: The United Kingdom and the United States formally adopt the Gold Standard.

- 1944: The Bretton Woods Agreement establishes a new global monetary system pegged to the U.S. dollar.

- 1971: The collapse of Bretton Woods leads to the modern system of floating exchange rates, a shift which triggered several historical currency crises.

- 1996: Early online trading platforms for retail forex investors are launched.

- 21st Century: Algorithmic, AI, and high-frequency trading become dominant forces in the market.

The Forex Market Today

Today, the forex market is the largest and most liquid financial market in the world. It operates 24 hours a day, five days a week, across every time zone. According to the Bank for International Settlements’ latest Triennial Central Bank Survey, daily turnover now exceeds $7.5 trillion.

This immense market is driven by a diverse range of participants, including central banks, commercial banks, multinational corporations, hedge funds, and millions of individual retail traders. Its scale and accessibility make it a central pillar of the global financial system.

Frequently Asked Questions

Who were the earliest forex brokers or money changers?

The earliest known forex brokers were Babylonian merchants and Roman money changers called argentarii. They operated in ancient marketplaces, assessing the value of different coins and facilitating exchanges for traders and travelers.

What led to the creation of the modern forex market?

The modern forex market was created by a combination of factors in the early 1970s: the collapse of the Bretton Woods system, the subsequent transition to floating exchange rates, the deregulation of international capital controls, and major advances in telecommunication and computing technology.

How did technology change forex trading?

Technology completely transformed forex trading by enabling electronic platforms, which provided real-time pricing and democratized access for retail traders. More recently, it has introduced high-frequency and algorithmic trading, drastically increasing the speed, volume, and efficiency of the market.

Why did the Bretton Woods system collapse?

The Bretton Woods system collapsed in 1971 due to growing economic pressure on the United States, including a depletion of its gold reserves. The fixed exchange rates could no longer support the realities of the changing global economy, leading the U.S. to suspend the dollar’s convertibility to gold.

What is the current size of the global forex market?

The global forex market is the largest financial market in the world, with a daily trading volume that exceeds $7.5 trillion.

Conclusion

The history of forex trading is a direct reflection of human economic development. From the simple exchange of goods in ancient markets to the complex, AI-driven transactions of today, the need to exchange value across borders has driven continuous innovation.

By understanding its origins—from the first coins to the Gold Standard and the dawn of the internet—we gain a deeper appreciation for the forces that shape today’s interconnected global economy.