Historical Price of Gold: Tracing Value from 1900 to the Present

From a government-fixed price of just over $20 to a market-driven value soaring past $4,000, the historical price of gold tells a dramatic story of economic change, global crises, and shifting investor sentiment. For over a century, gold has transformed from a rigid monetary anchor into a dynamic safe-haven asset, reflecting the world’s financial anxieties and ambitions.

Understanding this journey is about more than just numbers on a chart. It reveals how major events, from the Great Depression to the COVID-19 pandemic, have shaped gold’s role as a store of value, an inflation hedge, and a crucial component of a diversified investment portfolio.

The Era of Fixed Prices: Gold from 1900 to 1971

For the first seven decades of the 20th century, the price of gold was not determined by market forces but by government decree. This period of stability was defined by the gold standard, where the value of the U.S. dollar was directly tied to a specific amount of gold.

1900–1933: Anchored at $20.67 per Ounce

With the passage of the Gold Standard Act of 1900, the United States formalized its commitment to a dollar backed by gold. The price was fixed at $20.67 per troy ounce, a figure that remained remarkably stable for over 30 years. This system provided a predictable monetary foundation, as detailed in the broader history of the gold standard.

1934–1971: The $35 per Ounce Devaluation

The economic pressures of the Great Depression forced a major policy shift. In 1933, President Franklin D. Roosevelt took the U.S. off the gold standard domestically, and in 1934, he devalued the dollar by raising the price of gold to $35 per ounce. This new fixed price held for nearly four decades, even as post-war inflation began to erode the dollar’s real value.

From Monetary Anchor to Market Commodity: Gold After 1971

The global monetary system was permanently altered in 1971. The event, often called the Nixon Shock, saw the U.S. completely sever the dollar’s link to gold, allowing its price to be determined by supply and demand for the first time in the modern era. This ushered in a period of volatility and spectacular growth.

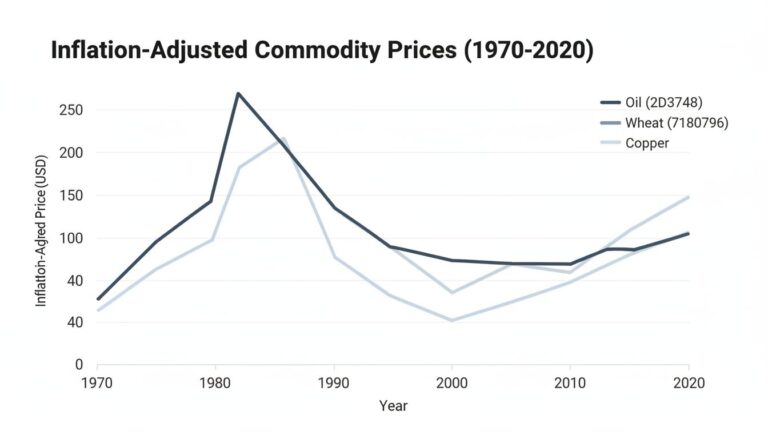

The Volatile 1970s: Inflation and Geopolitical Shocks

Once freed from its peg, gold’s price surged. Fueled by rampant inflation, oil crises, and geopolitical anxiety, the price climbed steadily, reaching $200 per ounce by late 1978. The decade culminated in a speculative frenzy, pushing gold to a peak of approximately $850 per ounce in January 1980.

Stagnation and Correction: 1980–1999

What followed the 1980 peak was a prolonged bear market. For nearly two decades, gold’s price languished, generally hovering between $300 and $400 per ounce. During this period of economic stability and strong equity markets, gold underperformed inflation, delivering negative real returns to investors.

The New Millennium Bull Market: 2000–2011

The 21st century sparked a dramatic reversal. A combination of central bank easing, the dot-com bust, and the 2008 Global Financial Crisis drove investors toward safe-haven assets. Gold entered a powerful bull market, rising from under $300 per ounce in 2000 to a then-record high of $1,921 per ounce in 2011.

Consolidation and Recovery: 2012–2018

After its 2011 peak, gold entered a consolidation phase. As economies recovered and stock markets rallied, gold’s appeal faded slightly, with prices drifting mostly between $1,100 and $1,300 per ounce.

The Recent Supercycle: 2019–2025

A new era for gold began in 2019. Trade tensions, the COVID-19 pandemic, and unprecedented government stimulus propelled gold past $2,000 per ounce for the first time in August 2020. This momentum continued as inflation surged and financial market volatility persisted, leading to a new supercycle.

- October 2024: Gold reached nearly $2,800/oz.

- September 2025: The price soared to $3,614/oz.

- November 2025: Spot prices approached $4,074/oz, setting a series of new all-time highs.

This recent surge has been supported by strong investor demand and significant purchases from central banks seeking to diversify their reserves away from the U.S. dollar, a trend tracked by institutions like the International Monetary Fund.

A Century of Growth: Gold Price 1900 vs Today

The nominal growth in gold’s price over the last 125 years is staggering. Comparing the fixed price at the turn of the 20th century to the market-driven highs of the 21st century highlights its long-term appreciation.

- Price in 1900: $20.67 per ounce (fixed)

- Price in November 2025: ~$4,074 per ounce

This represents a nominal increase of nearly 200 times its original value. However, this figure doesn’t account for inflation and changes in historical purchasing power.

Tracking the Real Value of Gold: A Hedge Against Inflation?

While its nominal price has soared, gold’s reputation is built on its ability to preserve wealth. The history of gold vs inflation shows a mixed but often positive record. Gold is widely considered an effective long-term hedge, particularly during periods of high or unexpected inflation.

For instance, gold’s price exploded during the high-inflation 1970s but failed to keep pace with inflation during the disinflationary 1980s and 1990s. Analysis shows that gold tends to outperform when economic or geopolitical stress is high and underperform when stability and growth prevail. It’s important to note that when adjusted for inflation, gold’s 1980 peak remains one of its highest points in real terms.

To put its value in perspective, the $35 price set in 1934 is equivalent to about $800 today when adjusted for Consumer Price Index (CPI) inflation. This demonstrates that gold’s current price is significantly higher in both nominal and real terms compared to that era.

A Look at Gold as an Investment History

As an investment, gold has a unique profile characterized by cycles of boom and bust. Its long-term performance showcases several key traits:

- Volatility: Gold experiences extended bull and bear markets, such as the negative real returns seen from 1980 to 2000.

- Spectacular Runs: The periods of 1971–1980, 2000–2011, and 2020–2025 saw multi-fold price increases.

- Resilience in Crises: During the 2008 Global Financial Crisis and the COVID-19 pandemic, gold often outperformed other assets, cementing its safe-haven status.

Since 1971, gold’s average annual return is estimated at 7–8%. While this trails the long-term returns of major stock indices like the S&P 500, its low correlation to equities makes it a valuable tool for portfolio diversification, as noted in analyses by financial authorities like the Federal Reserve on monetary history.

How Gold Prices are Tracked and What Drives Them

Understanding gold’s price requires knowing how it’s measured and what influences it. This knowledge is key for anyone tracking the real value of gold.

Tracking Gold’s Value

Gold is globally quoted in U.S. dollars per troy ounce. The two main benchmarks are the global spot price, which reflects real-time transactions, and the LBMA Gold Price, set in London. Investors also use ratios like the Dow-to-gold or real estate-to-gold ratio to measure its purchasing power relative to other assets. For example, as of July 2025, it took approximately 142 ounces of gold to purchase the average U.S. home.

Key Drivers of Historical Gold Prices

A complex mix of factors influences gold’s value. The most significant drivers include:

- Monetary Policy: Interest rates and quantitative easing impact the opportunity cost of holding non-yielding gold.

- Inflation Expectations: Rising inflation often drives investors to gold as a store of value.

- Global Crises: Wars, pandemics, and financial instability enhance gold’s safe-haven appeal.

- U.S. Dollar Strength: Gold is priced in dollars, so it typically has an inverse relationship with the dollar’s value.

- Central Bank Demand: Purchases by central banks, especially for de-dollarization, provide a strong floor for prices.

- Investor Risk Appetite: When investors are fearful, they buy gold; when they are confident, they may prefer riskier assets like stocks.

Frequently Asked Questions

What was the price of gold in 1900 compared to today?

In 1900, gold was fixed at $20.67 per ounce under the US gold standard, while in late 2025, gold traded near $4,074/oz, reflecting nearly a 200-fold nominal increase.

How does gold perform against inflation over the long term?

Gold has generally preserved purchasing power in inflationary periods, often rising most during economic crises, but its real (inflation-adjusted) price can stagnate or decline for long stretches during stable periods.

Is gold a good long-term investment?

Gold’s long-term returns average about 7–8% since the 1970s, below equities, but it is valued for diversification and protection during market or currency crises.

Why did gold prices rise so sharply after 2020?

Post-2020 price surges were sparked by pandemic economic uncertainty, inflation, central bank stimulus, and increased demand for safe-haven assets, further boosted by central bank buying and global currency risk shifts.

How is the real value or purchasing power of gold tracked?

Analysts use inflation-adjusted price charts, asset ratios like real estate-to-gold or Dow-to-gold, and historical purchasing power comparisons to assess gold’s true value over time.

Conclusion

The historical price of gold charts a remarkable journey from a state-controlled monetary tool to a globally traded asset reflecting the pulse of the world economy. Its ascent from $20.67 to over $4,000 per ounce is a testament to its enduring appeal as a protector of wealth against inflation, uncertainty, and crisis.

While its path has been marked by volatility, gold’s performance over the last century solidifies its unique and lasting role in the financial landscape. For investors and historians alike, its price remains a powerful barometer of economic health and human sentiment.